First Look at HyperTracker: A Game-Changing Wallet and Perp Position Tracker

By Dead Cat Bounce - 31-Jul-2025

The CoinMarketMan (CMM) team has been hard at work building a slick new platform called HyperTracker, designed to track Hyperliquid wallet addresses and perpetual futures (perp) positions in real-time. Hyperliquid operates with a fully on-chain order book and offers full transparency, which HyperTracker leverages to deliver actionable insights.

Here’s my first user experience with HyperTracker, breaking down its features and how I see it levelling up my trading. Let’s dive in.

The Home Dashboard

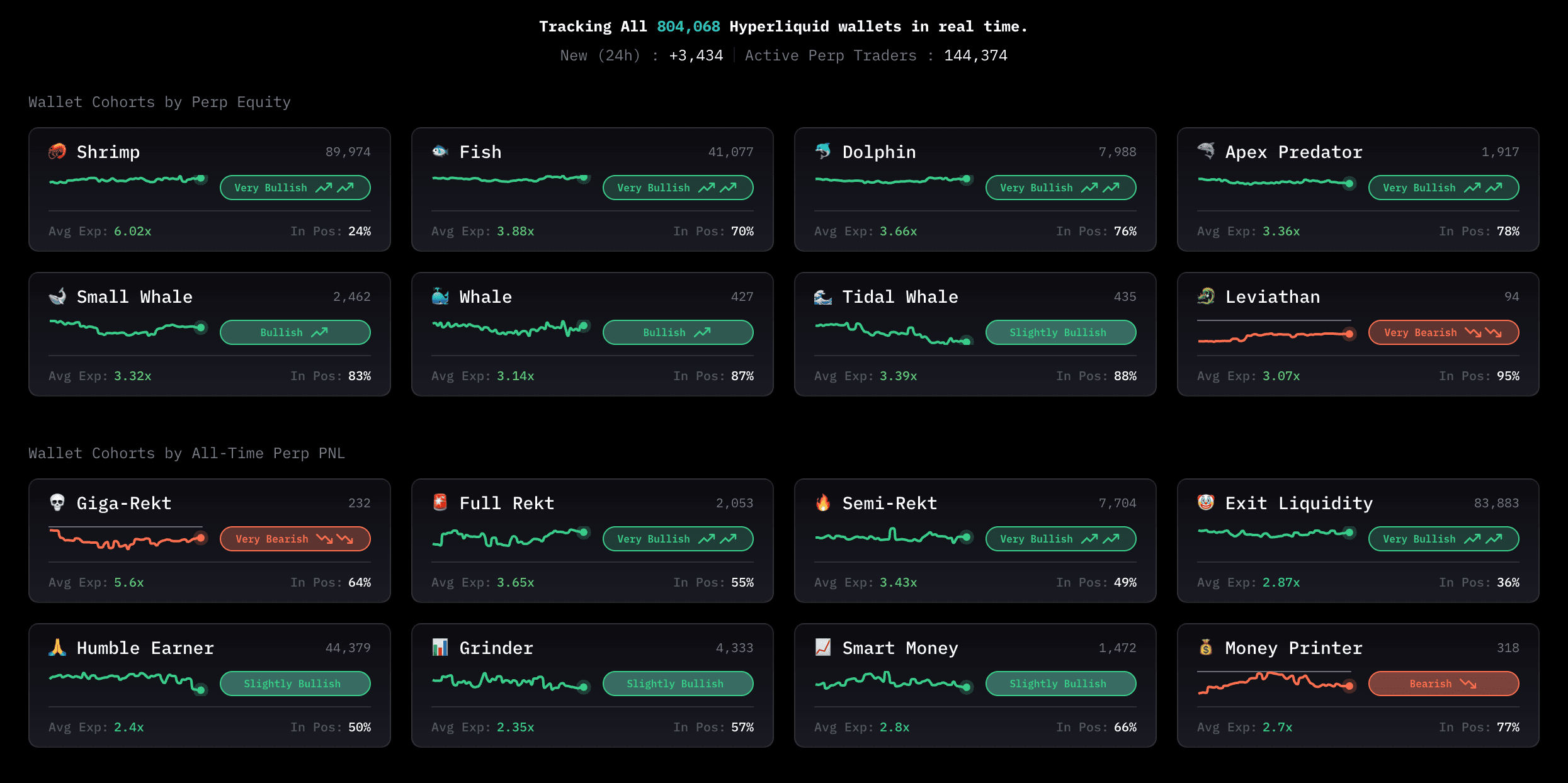

Right off the bat, HyperTracker’s home dashboard grabs your attention.

It lets you track Hyperliquid wallet addresses and provides real-time analysis of their current perp bias, split into two groups:

- Perp Equity

- All-Time Perp PNL

The naming is pure gold:

- Money Printer and Smart Money for the winners

- Full Rekt and Giga Rekt for the biggest losers

You quickly see that the worst-performing wallets are consistently on the wrong side of the trend, often holding the polar opposite bias of the Money Printer and Smart Money crews.

The Perp Equity view sorts wallets by size; from Shrimps and Fishes (smaller players) to Dolphins, Tidal Whales, and Leviathans (the big dogs).

When I’m analysing the market, I don’t get too excited seeing Shrimps, Fishes, or Rekt wallets piling into bullish positions at a key resistance level, history shows those moves often don’t end well.

The dashboard gives a quick overview of sentiment trends, helping you assess whether the crowd is heavily skewed in one direction.

The latest update also displays the average exposure of each cohort, revealing their leverage and conviction.

Remember: anyone can be bullish or bearish without capital at risk. This feature shows actual positioning.

Tracking Wallets

The Smart Money and Money Printer wallets aren’t always right, but they often have better timing and discipline. I imagine their positions reflect deeper market insight and sharper strategies. Tracking them gives you a clue into where real momentum might be.

Also right on the dashboard, you can analyse individual wallets. Just paste in a wallet address and get a full breakdown:

- Current perp positions

- Spot holdings

- Key stats like PNL and equity

It’s not about copy-trading for me. I prefer to make my own trading decisions. But the setup makes it really simple to follow top performers if that’s your thing.

And just to be clear:

Size ≠ Skill.

Some Leviathan wallets with massive equity are chilling in the Full Rekt section. Proof that big money doesn’t guarantee big brains.

Analysing wallets one by one helps you separate noise from signal and focus on traders worth watching.

Cohorts

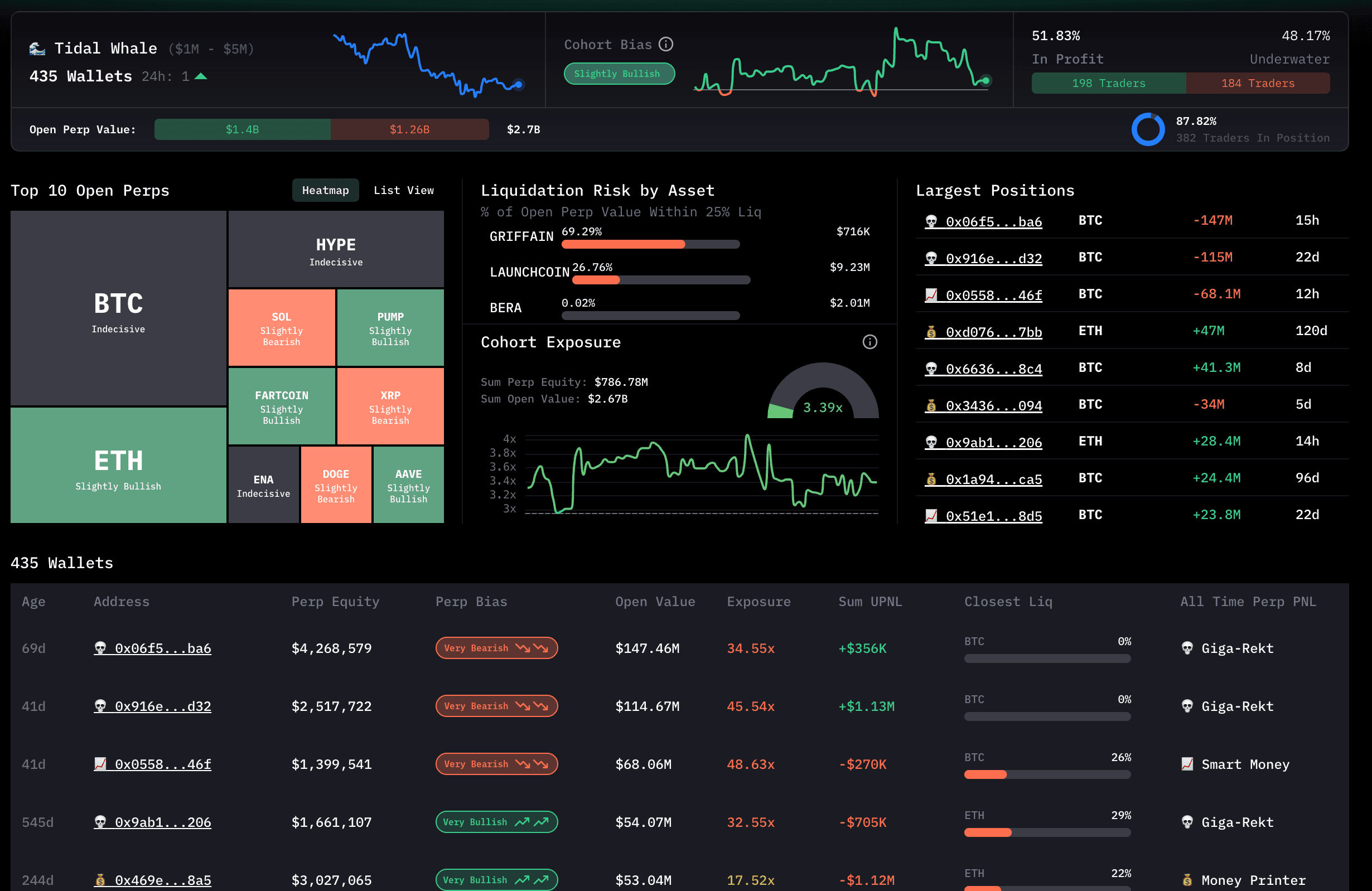

As mentioned earlier, wallets are grouped into cohorts, letting you analyse each one in depth.

For example, selecting Tidal Whales shows you:

- Their bias

- % in profit vs underwater

- Open perp value

- Top 10 assets they’re positioned in

- Liquidation risk by asset

- Exposure levels

...and more.

I always monitor moments when traders are forced to react through liquidations or stops. So insights into how many large wallets are underwater, or how much open perp value sits within 25% of liquidation, are invaluable to my daily process.

Each wallet is also tagged with an Exposure metric. Useful for spotting who’s overleveraged and might be a liquidation target.

Perps Section

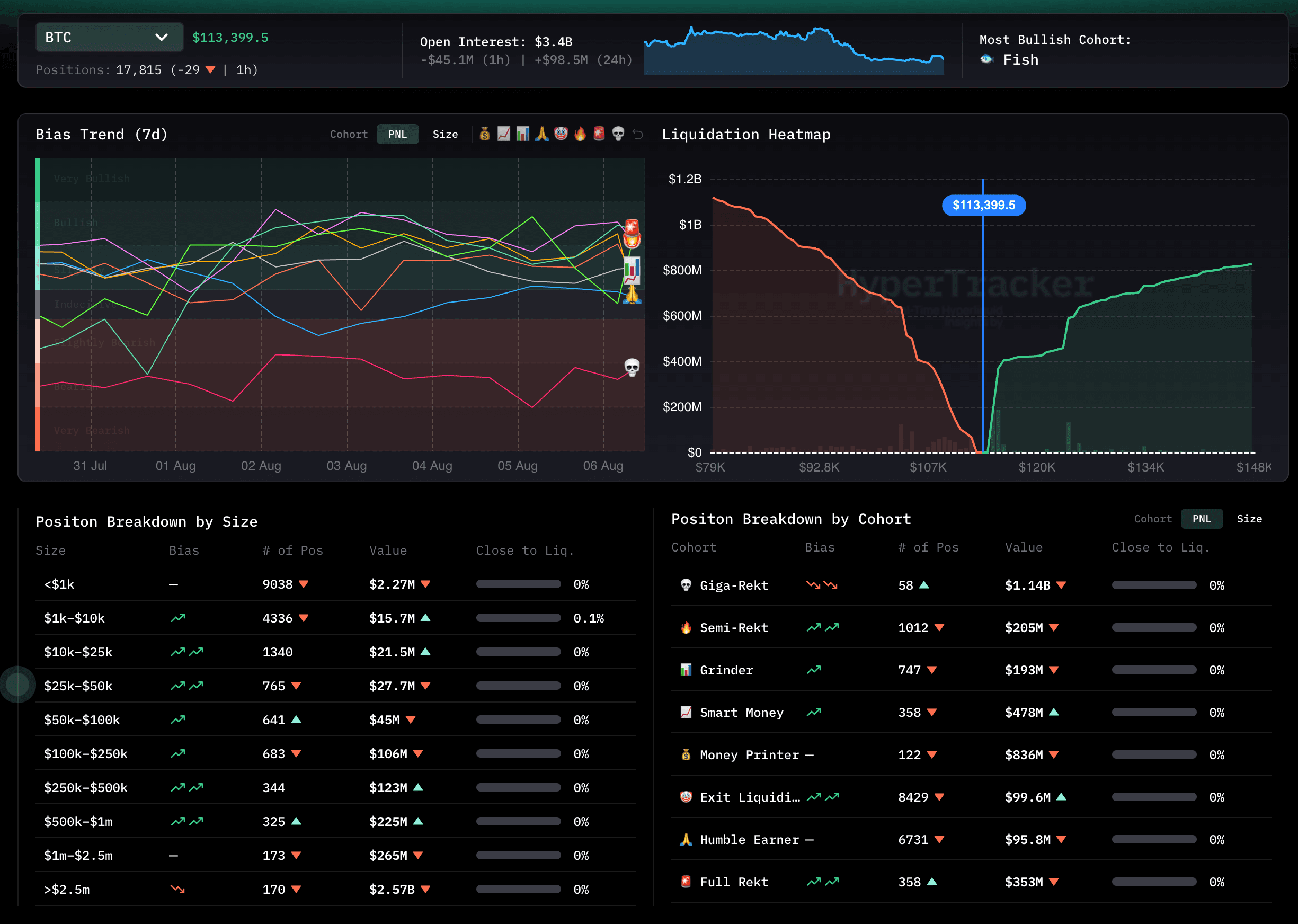

Navigating to the Perps section, I was impressed by how HyperTracker breaks down data by individual coin.

You get:

- A clean view of open positions

- Bias trends

- And my favourite: the Liquidation Heatmap

This tool is a gem for spotting where accounts are getting blown out.

When a technical level (support or resistance) lines up with a high-liquidation zone, it’s automatically a zone of interest.

I love buying into areas where liquidations are piling up. They’re often where price reverses as stops get cleared.

Another killer insight is the 7-day bias trend. It shows how top cohorts like Smart Money are positioning over time.

If it’s clean and they’re still buying, there’s no reason to go bearish without a damn good reason.

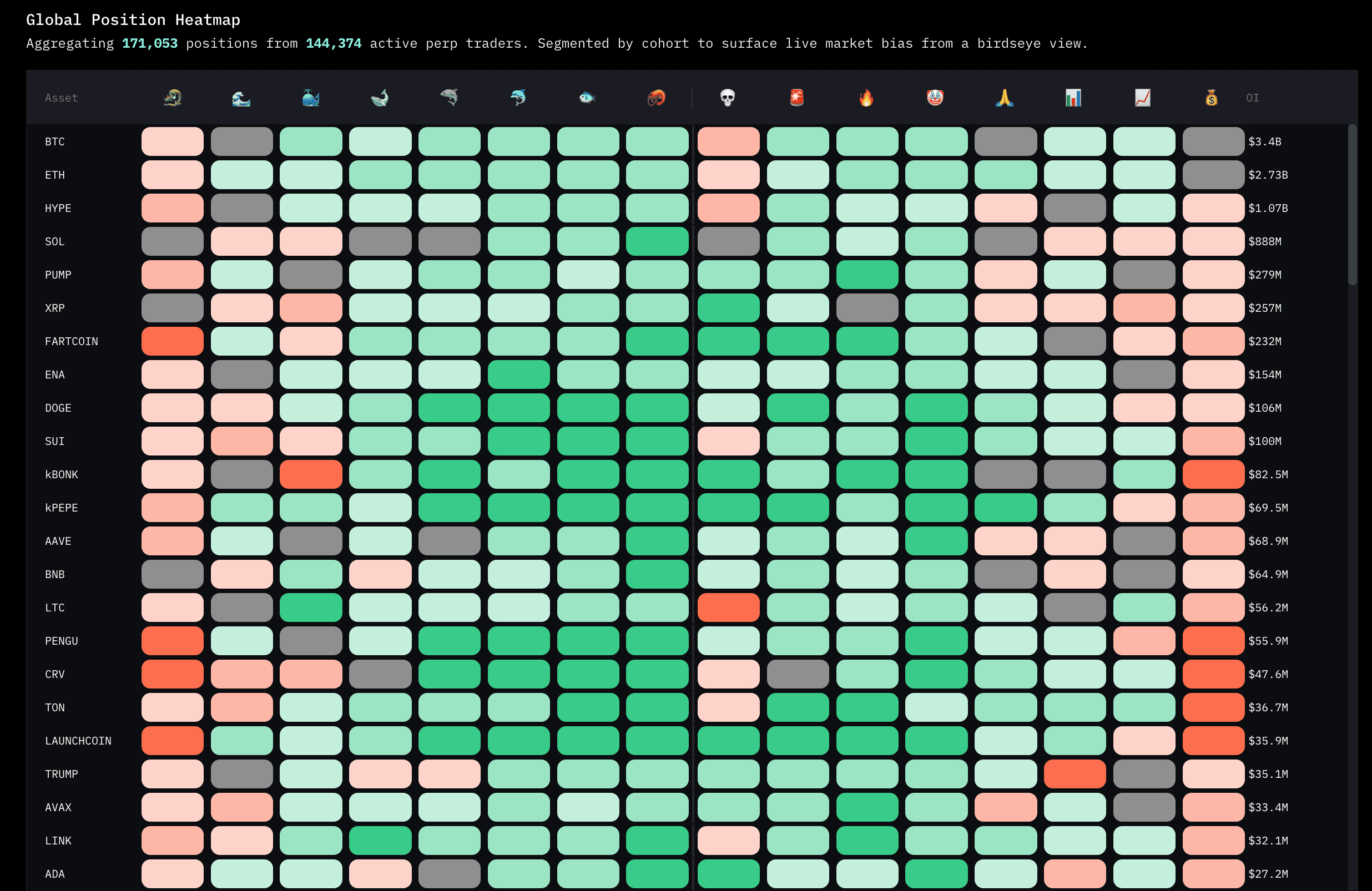

Position Heatmap

This is hands-down the slickest feature on HyperTracker.

The UI is perfect. Instantly shows how wallets are positioned across assets.

You can spot anomalies like:

Money Printer wallets going bearish on an asset while Giga Rekt wallets are super bullish.

Moments like that make me stop and think:

Why are the best traders betting against the crowd?

What am I missing?

This kind of insight forces you to challenge assumptions and refine your edge.

Final Thoughts

My conclusion? HyperTracker brings a ton of value, and it’s more accessible than ever before.

Use the data as a building block, not a crystal ball.

You still need to confirm with price action, key levels, and your own analysis.

That said, it’s already part of my trading toolkit, and I’m looking forward to all the updates that are still on the way.