Trader Spotlight on Jack's OTC Trading Desk

By CMM Team - 23-Aug-2020

Unlike other trading spotlight interviews, this one focuses on a team.

Readers of the CMM trading blog are familiar with the ongoing series of spotlight posts that feature the stories and advice from skilled crypto traders who use CMM. But this post interviews a slightly different type of trader. Called “Jack,” this automated trading specialist piloted Coin Market Manager for his trading firm’s analysis and reporting needs over a period of five months. His trading background includes seven years trading experience both in legacy and cryptocurrency markets with three of those focusing solely on trading automation. His firm’s trading strategies include a mix of scalping, intraday and swing trades during both trending and ranging market conditions.

Jack came to Coin Market Manager because of his firm’s dire need for reporting and data flow efficiency to accelerate portfolio analysis efforts and maximize trade strategy profitability.

An Interview with Jack and his Team

This article features takeaways from the conversation instead of a long-form transcript.

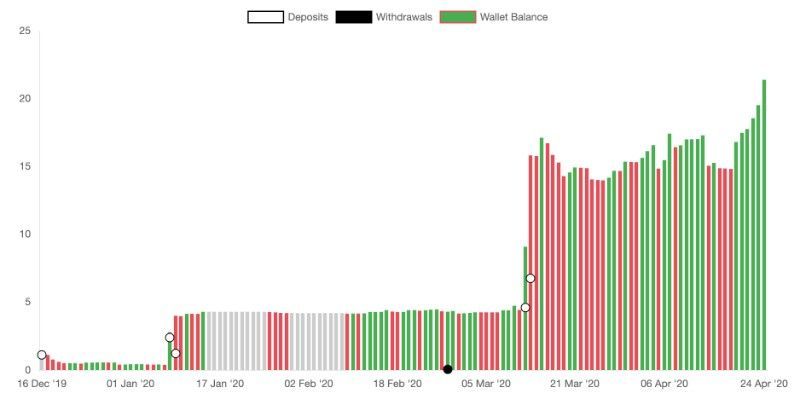

a screenshot shared by Jack from his CMM account

Jack and his team begin their workday by checking the Total Net Worth section of his Coin Market Manager dashboard. Rather than accessing each account and logging balances manually, this allows them a quick “macro view” of portfolio balances across multiple accounts, in both Bitcoin and US dollars.

The team finds the Balance History feature to be a quick, effective method to toggle between accounts and see balances for each. Rather than sifting through mind-numbing text data, they quickly identify balances that are experiencing drawdown and require further evaluation.

To perform thorough account-level analysis, Jack and his team require more specific data like win-ratio, average win and loss PNL, and funding and fee costs. Coin Market Manager provides the support they need with the Account Analytics feature. With this deep level of feedback on the performance of specific strategies, the team can then use this to identify potential improvements

While trading account summary data is important for analysis, what has proven most vital for Jack and his team is strategy performance analysis on a per-trade level.

His team relies heavily on this tool to quickly see key data points like trade history, win-rate and account gains per trade. Trade histories include the most specific data points like position entries and exits, take-profits and more. Complimenting this data is each trade’s life cycle from open to close overlaid on the instrument’s chart.

Jack and the team all agree that the time saved by not having to flip back and forth between this data and an external chart is substantial.

Refining an Edge with CMM

Jack’s story is one of many cases where Coin Market Manager tools improve the speed, skill and success of crypto traders of all sizes. Detailed, automated analytics prove to not only save time, but also money.

CMM enables the team to more effectively perform their duties, identify benchmarks and set attainable trading goals.

It allows more efficient analysis, collaboration and portfolio tracking which, in this case, equates to stronger profits and success.

CMM thanks Jack and his team for sharing their story for publication on this blog.