Trader Spotlight on TraderAditya

By CMM Team - 01-Sep-2020

Welcome to the beginning of the Trader Spotlight series!

These blog posts feature high-signal interviews with successful traders from the Coin Market Manager community that explain their trading journey, how they became profitable, and advice they wish they learned from the beginning.

An Interview with Trader Aditya

How long have you been trading?

TA: I have been trading for about 3.5 years now.

How long did it take you to become consistently profitable?

TA: It took me at least 1.5 years to become profitable. I did not have a system I used before that—just a few set of rules I followed, so it never was consistent before.

Talk about where you started and how you reached where you are today?

TA: In 2016, I bought my first set of bitcoins. Slowly, I discovered margin trading and I used to deposit small amounts on Bitmex and try to trade having pretty much no idea how it all worked. Initially, I just went on to YouTube to watch how other people traded and their style, but overtime it was clear that none of them could predict everything right.

This was probably my first lesson that you can never be right all the time and losses are part of the game. I blew up a dozen accounts on Bitmex margin trading. Then I slowly started reading up online on building your own system and it took off from there. Basically, the only way to consistently make money is find an edge and simply follow that. Trader Dante, ROC, Sam Seiden and ICT are the main influences of what I have right now. I never took their paid course, but then they made me realise how important it is to have a trading system in place before you even take a trade.

A trading system can simply start off with a set of rules about where you want to enter, exit and where your invalidation level is and then move on from there. I simply use Technical Analysis to manage my risk. Supply and demand and moving averages help me to figure out my entry, targets and my invalidation levels. Most of it boils down to risk management. This is pretty much my system. I try to follow it most of the times and if I become overly confident about a position, the market never fails to humble me.

How long have you been using CMM?

TA: I've been using CMM for about a straight month now after my buddy on Twitter RookieXBT introduced me to it.

How has CMM affected your trading?

TA: Honestly, I have been wanting a service similar to this for a long time and I could not find any. This reduces a lot of manual work for me. Before I used my Dairy or made an excel sheet to journal my trades but now I simply have to hit update and all the stats are shown very clearly. I really like how they’ve even mentioned how much time a trader has spent on a position and how much maker/taker fees he's paid by. That's something I have ignored noting down before manually. Platform has pretty much everything I would want in a journal. For people who are starting out, I think this makes it very simple for them to backtest their strategies in real time without having to manually do things.

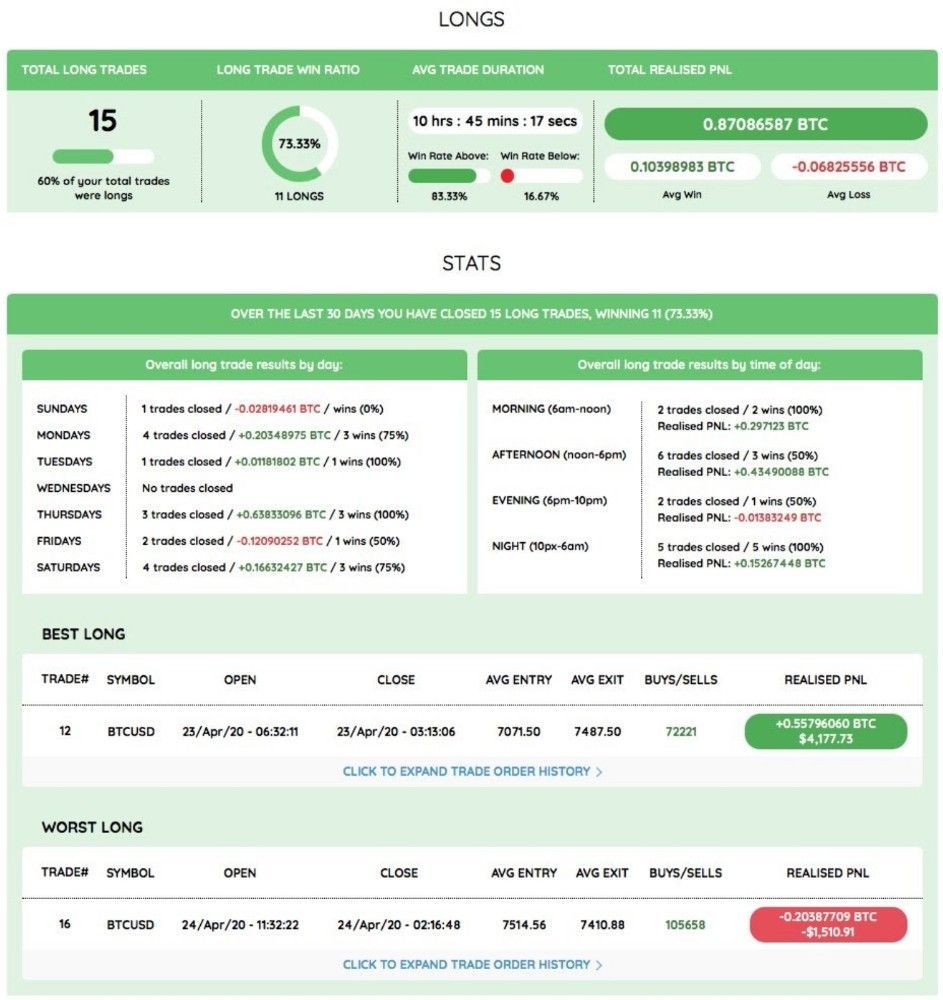

The image here clearly shows when I was Long and which times were more profitable, this is very helpful in selecting what times to trade and what time to just leave the market do its thing.

Calculating how much I spent and received in maker/taker fee helps in calculating the cost of doing business and I could definitely use more maker orders.

What advice would you give to a younger version of yourself that just started trading?

TA: Have a trading plan for pretty much all scenarios possible. When will you get out of the trade? When do you cut your position if it misses your target by a few dollars? If you get stopped out, do you enter the same trade again? All these questions among others should have been answered before you even click a single button on your terminal. Failing to do so, has cost me a lot of money and it will for you too in the long run.

When I first started out, I would try to copy traders online and try to make money but then it just didn't work out. The reason for that is everyone's system is different. You cannot copy people's trades and make money simply because you don't have the same risk profile, the same conviction and the same fill. This is exactly why the entire idea of a "Paid Group'' is a sham. You cannot consistently copy people and make money. It might happen sometimes, yes but unless you take every trade, the same risk as them, it's not happening. I cannot stress on this point enough. Understand that trading is highly subjective and what works for someone else will not necessarily work for you.

Also, learn to manage risk. If you've seen my 0.1-to-1 BTC challenge, you can clearly see how fast I got out of trades which went south and the losses did not affect me much. You can be wrong more times than right and still make money. This also goes for using leverage. Most people don't understand why it is used and should first look into how it works and then use leverage. Having big positions might look fancy on Twitter but at the end of the day you're multiplying your risk and if you're not using it to reduce counterparty risk on exchanges then you're probably doing it wrong.

Know what to trade. Now there are maybe 10 different pairs you can trade regardless of which market you trade in (i.e., stocks, forex, or crypto) just figure out what works for you. Personally, I trade BTCUSD on Bybit and BTC and ETH MOVE Options on Delta Exchange. Apart from trading ETHUSD if I see a solid setup, these are primarily the only two things I trade because I know I'm comfortable trading them. That's all that matters. There is no need to be in every trade always.

Accept that you cannot make money every month, and that's totally fine. Figure out when NOT TRADING works out for you and completely distance yourself from the market. Take breaks after huge losing or winning streaks. I usually take a two-month break after winning too big or losing too big. It helps clear up your mind. Following your own system is all that matters.

Lastly, have a life outside of trading. This isn't directly related to trading but this is very important for your mental health. Helps reduce a lot of stress and helps you clear your mind for the coming day.